Additional Car Insurance Protection

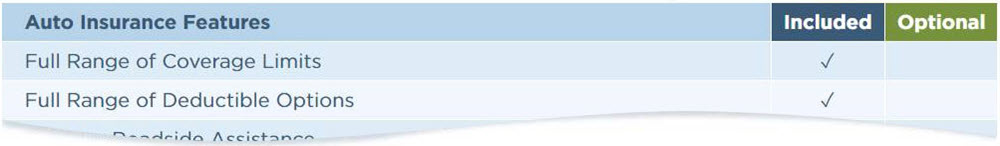

Depending on your policy, auto insurance coverage options can vary. The AARP Auto Insurance Program from The Hartford offers additional coverages to help protect you and your car.

Accident Forgiveness

As long as all the drivers on your car insurance policy have a clean driving record for five straight years, you’ll qualify for

accident forgiveness.

‡

Disappearing Deductible for Auto Insurance

We believe in rewarding great drivers. With our optional disappearing deductible, your collision deductible on your car insurance policy can be reduced by up to $500 as long as you keep a clean driving record.‡

24/7 Roadside Assistance for AARP Members

Help is available when you need it most. If you have a roadside emergency, like a flat tire, dead battery or you lose your keys, we can help. Roadside assistance and towing service is available to anyone who has a car insurance policy with The Hartford through RESCUE-1-800

®. Simply call roadside assistance and towing at

800-322-7789. This service is available 24 hours a day, 7 days a week.

New Car Replacement Coverage

If you total your new car, we’ll pay to replace it with one of the same make, model and equipment. And we’ll do it without subtracting anything for depreciation.§§

RecoverCare – Assistance After an Accident

The AARP Auto Insurance Program from The Hartford protects more than just your car. If you’re ever hurt in an accident, our RecoverCare§ coverage pays you back for things you can’t do yourself, like:

- House cleaning

- Lawn maintenance

- Snow removal

- Transportation services

- Food preparation

- Dog walking

If the injury keeps you from driving to work, we can also help you pay for alternate transportation.

Lifetime Car Repair Assurance

After a covered claim, we’ll help you find a trusted repair service so you don’t have to go through the hassle yourself.

If you use one of the 1,600+ repair shops in our approved network, we’ll stand behind the quality of the repairs for as long as you own or lease your vehicle.

24/7 Car Insurance Claims Hotline

Accidents can happen at any time. That’s why you need a

car insurance company that can respond immediately – no matter what time you call. The Hartford has earned a reputation for integrity and trust, and we’re proud to have a record of high customer satisfaction ratings for claims services.

Our 6-point Claim Commitment assures you’ll get prompt and caring service throughout your claims experience. File a claim with us 24/7 by calling

877-805-9918. We’ll walk you through the

car insurance claims process for AARP members.