What Is a No-Fault State?

You may assume that if you’re in a car accident caused by another driver that their

car insurance covers medical expenses for you and your passengers. However, if you live in a no-fault state, you could still be responsible for these costs even if the accident isn’t your fault. In no-fault states, each driver in an accident must file a claim with their own insurance company, no matter who is at fault.

So, if you live in a no-fault state and you’re rear ended by someone talking on their phone, you will still need to file a claim with your insurance company if you or your passengers are hurt. That’s why if you live in a no-fault state, it’s very important that you purchase

personal injury protection (PIP insurance), also known as

no-fault insurance, to cover these expenses. Even if you don’t live in a no-fault state, your state may still allow you to get PIP for extra coverage.

No-Fault Insurance States

The fault system was created to help lower the cost of car insurance and the number of small lawsuits resulting from auto accidents. However, if you live in a no-fault state, you can still sue at-fault drivers if your medical bills meet the monetary threshold established in your state.

State auto insurance laws and requirements vary, so it’s important to know the rules where you live.

For help understanding what’s required in your area, call our representatives at

888-413-8970.

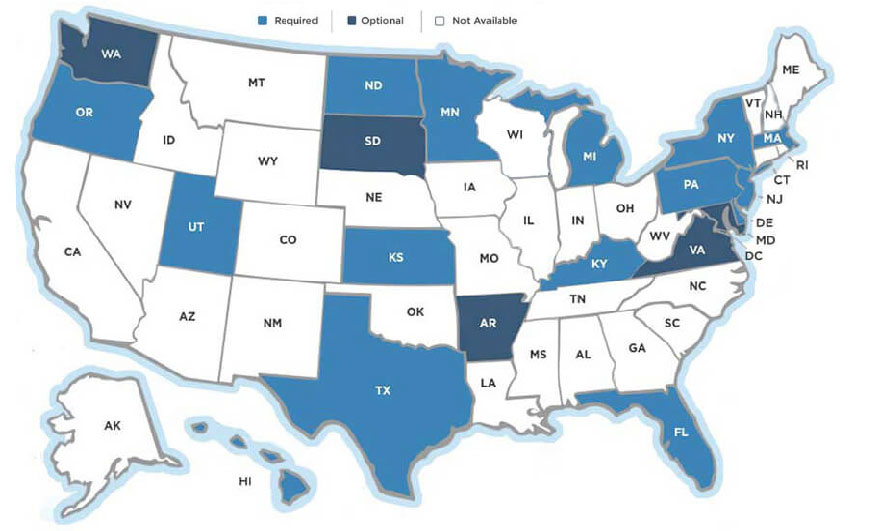

Find out if your state requires you to have PIP coverage. States that require no-fault insurance coverage include:

Some no-fault states don’t require PIP insurance but offer this no-fault insurance as optional coverage. These states include:

And finally, some at-fault states require that you carry personal injury protection coverage. An at-fault state is also known as a tort state and they have fewer restrictions on lawsuits than no-fault insurance states. Drivers in these at-fault states have the option to buy no-fault insurance:

Who Pays in a No-Fault State?

In states with a no-fault law, these insurance laws say that after a car accident, each driver must file a claim with their own insurance company no matter who is at fault. If PIP coverage is available in your state, it can help you and your passengers pay for:

-

Medical bills

-

Health insurance deductibles

-

Lost wages

-

Essential costs, like childcare

-

Funeral expenses

Even if your state requires or allows you to purchase no-fault insurance, it won’t cover everything. For example, if you back into your neighbor’s fence, you’ll need liability coverage to pay for the property damages. And if your car is damaged in an accident, you’ll need collision insurance to help pay for the repairs for your vehicle.

If You’re in a No-Fault State, Get Coverage Today

Whether you live in a no-fault state or not, it’s important to get the right protection. To learn more about personal injury protection coverage and find out if it’s available where you live, call our representatives at

888-413-8970. You can also learn about other required and optional car insurance coverages and get

car insurance quotes online.

At The Hartford, we have a reputation for integrity and trust, plus high customer ratings for claims services. You can count on our car insurance to be there when you need it most.

You may assume that if you’re in a car accident caused by another driver that their

You may assume that if you’re in a car accident caused by another driver that their  The fault system was created to help lower the cost of car insurance and the number of small lawsuits resulting from auto accidents. However, if you live in a no-fault state, you can still sue at-fault drivers if your medical bills meet the monetary threshold established in your state.

The fault system was created to help lower the cost of car insurance and the number of small lawsuits resulting from auto accidents. However, if you live in a no-fault state, you can still sue at-fault drivers if your medical bills meet the monetary threshold established in your state.